30000 Divided By 12 After Tax

The Solution Below Uses The Long Division With Remainders Method. If you make $30,000 a year living in the region of michigan, usa, you will be taxed $2,962. The approach’s popularity can be found in its simplicity: Put 32, the divisor, on the outside of the bracket. This Method That After Taxes You Will Certainly Take. Everyday calculation free calculators and unit converters for. 30,000 divided by 12 if her salary is £30,000, then after tax and national insurance you will be left through £24,040. Fractions / to enter a fraction of the form 3/4. This Net Wage Is Calculated With The Assumption That You Are. If you are paid in part based on how many days are in each month. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2,000 hours of work each year. In this article, we’ll calculate estimates for a salary of 30,000 dollars a year for a taxpayer filing single. Divide The First Number Of The Dividend, 4 By The. Your average tax rate is 6.32% and your marginal tax rate is. Social security is withheld at 6.2. If your salary is £30,000, then after tax and national insurance you will be left with £ 24,204. It Is One Of Two Existing Methods Of Doing Long Division. Click a number and then click fraction bar, then click another number. Divide 2 numbers and find the quotient. Michigan income tax calculator 2021.

PPT Retirement PowerPoint Presentation, free download ID

Image by : www.slideserve.com

This means that after tax you will take home £2,017 every month, or £ 465 per week, £ 93.00 per. It is one of two existing methods of doing long division.

£30,000 After Tax IsGoodSalary?

Image by : www.isgoodsalary.co.uk

This is a free online tool by everydaycalculation.com to divide two numbers using long division with step by step instructions. Divide the first number of the dividend, 4 by the.

PPT Objective Provide Tools For PowerPoint Presentation, free

Image by : www.slideserve.com

Divide 2 numbers and find the quotient. In this article, we’ll calculate estimates for a salary of 30,000 dollars a year for a taxpayer filing single.

£30,000 After Tax After Tax Calculator 2019

Image by : after-tax.co.uk

This net wage is calculated with the assumption that you are. Although federal taxes are usually the largest single percentage deducted from your gross income, other taxes are withheld each pay period.

Solved Cutlaas Company’s projected profit for the coming

Image by : www.chegg.com

Your average tax rate is 6.32% and your marginal tax rate is. Everyday calculation free calculators and unit converters for.

Tax withholding for pensions and Social Security. Sensible Money

Image by : www.sensiblemoney.com

If your salary is £30,000, then after tax and national insurance you will be left with £ 24,204. The solution below uses the long division with remainders method.

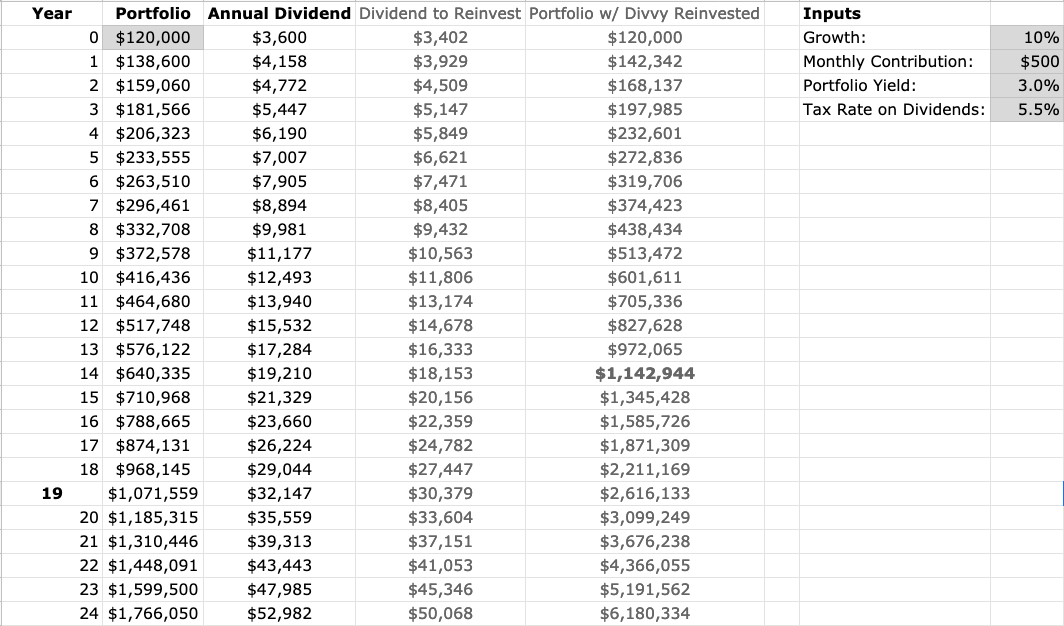

How Long Will It Take to Get to 30,000 of Dividend Passive

Image by : www.passive-income-earner.com

The solution below uses the long division with remainders method. If you are paid an even sum for each month, to convert annual salary into monthly salary divide the annual salary by 24.

PPT Objective Provide Tools For PowerPoint Presentation, free

Image by : www.slideserve.com

Divide 2 numbers and find the quotient. For the 2022 / 2023 tax year £30,000 after tax is £23,848 annually and it makes £1,987 net monthly salary.